Marty and Max: January market report

Nationally, the month of January brought good news. Along with resolutions and the turning of a new calendar year, the real estate market is also starting to see the light at the end of a tunnel. Forbes reports that “The end may finally be in sight for a prolonged slump in the U.S. housing market, according to Goldman Sachs strategists.”

Price reductions beat expectations as adjusted for seasonal prices. Inventory continues to be very low. There is more buyer demand and homes continue to sell with fewer reductions. The normal range for price reduction is 30-35%. Median home prices are up a quarter percent.

Median price for newly listed homes also climbed. There are 31% fewer homes under contract and 23% fewer pending's. In summary, buyer demand has bounced off the bottom, at least for now.

This week we are going to take a look at several key factors to watch in the market. Since the top end of the market behaves differently than the lower end of the market, we will be looking at Shoshone County as a whole and also splitting the Shoshone County market into quartiles. Quartiles break the market into segments: bottom 25%, lower middle 25%, upper middle 25% and upper 25%.

To get a full market report of your specific city emailed to you every week, head to martyandmax.com.

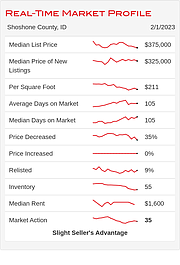

This week the median list price for Shoshone County is $375,000 with the market action index hovering around 35. The MAI tells us what the market is doing in a brief snapshot. This is an increase over last month's market action index of 34. Locally, the percentage of price reductions fell approximately 7.4% and is now back in the normal range.

Again this week we see prices remain roughly at the level they’ve been for several weeks. In the quartile market segments, we see prices have settled at a price plateau across the board. Prices in all four quartiles are basically mixed.

Since we’re significantly below the top of the market, look for a persistent up-shift in the Market Action Index before we see prices move from these levels. While prices have been basically flat, the price per square foot has been heading downward. While not a sign of broad strength in a market, larger homes are becoming more available and buyers are tending to get more home for their money.

Inventory has been falling in recent weeks. It is important to note that declining inventory alone does not signal a strengthening market. Look to the Market Action Index and Days on Market trends to gauge whether buyer interest is changing with the available supply.

While the Market Action Index shows some strengthening in the last few weeks, prices have not seemed to move from their plateau. Should the upward trend in sales relative to inventory continue, expect prices to resume an upward climb in tandem with the MAI.

In summary, buyer demand has bounced off the bottom, at least for now. To receive a copy of the complete market report for your city go to martyandmax.com.

• • •

Marty Walker is a licensed real estate professional and paid consultant. Information shared in this column is of a general nature. For specific questions in relation to your unique property, email to set a time for a consultation.

MartyandMax.com | Martywalker@remax.net