Marty and Max: How To Ensure You Are Insured

Hey Max: Home values and building costs are rising. How can I ensure my home is protected so if my home burned to the ground I can afford to rebuild?

To educate prospective homebuyers about their property insurance needs, the Insurance Information Institute (Triple-I) and the National Association of REALTORS® (NAR) have released The Homebuyers Insurance Handbook.

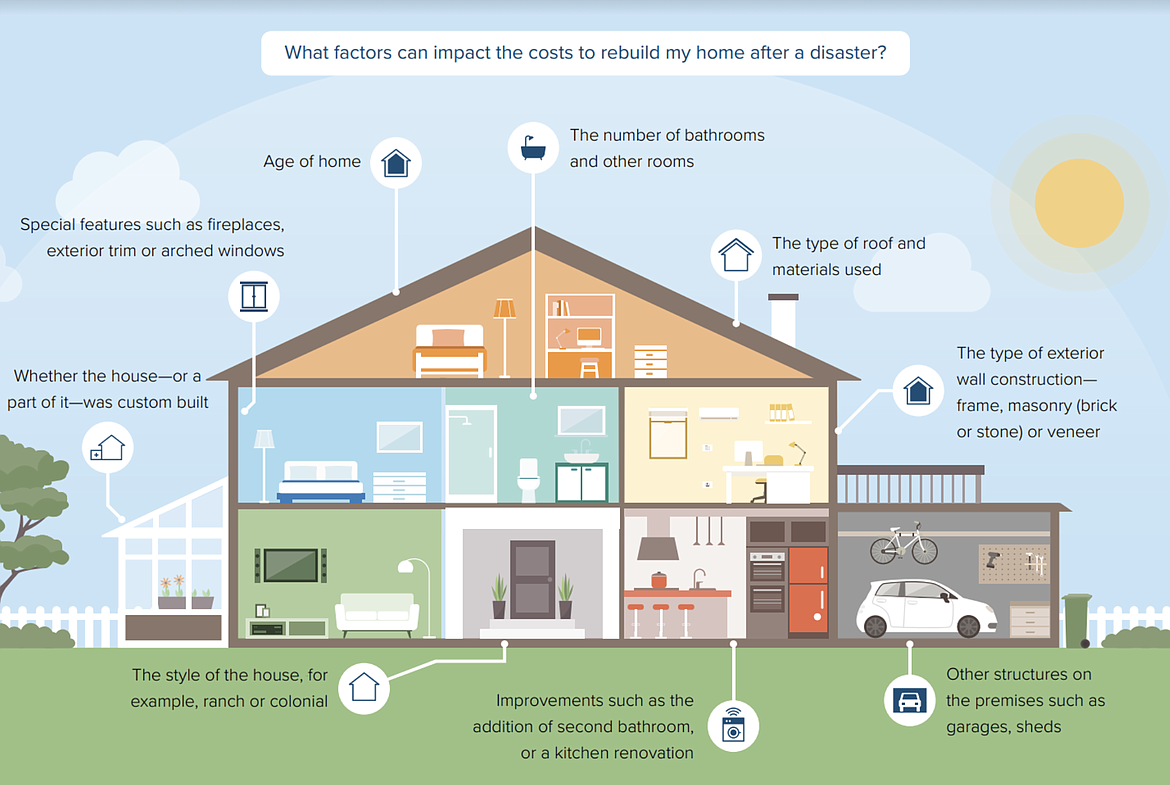

The amount of coverage for the home itself should be based on what it would cost to rebuild the structure in the event of a total loss, in its current location, with comparable construction materials–at prices that may be affected by disaster-related demand surges or inflation. Protection to rebuild a home's structure is typically listed as dwelling coverage. Once the home's dwelling coverage limit has been established, personal property coverage usually equals 50% to 70% of that number. Also, to be covered for property damage caused by either floods or earthquakes, a homebuyer must purchase separate policies because both perils are excluded in a standard homeowners insurance policy, the Handbook notes.

Kathy Bush with Flathead Insurance is one of the most respected professionals and SME(Subject Matter Expert) in Idaho and her thoughts are, “If you currently own a home, make sure you do an annual review with your insurance advisor. This will make sure you are on pace with inflation and the increasing cost of rebuilding. If you are a new homebuyer, check with your insurance advisor concerning protection class. If you are in an outlying area or have a lot of trees surrounding your property, you may have difficulty insuring a property or the cost could be more than you expected.”

Six Ways to Get the Right Amount of Homeowners Insurance

Raise your deductible in exchange for lower premiums. A policy deductible is the amount you are responsible for paying towards a covered expense before the insurer will pay on a claim. The higher your deductible, the more money you can save on your insurance premium. However, your insurance policy may have a separate deductible for major disasters such as earthquakes, hurricanes, or wind/hail storms if you live in a disaster-prone area. Consider that when deciding whether to raise the standard homeowners deductible.

Ask about discounts and bundle options. Most insurers provide discounts for home modernization improvements and security devices such as smoke detectors, burglar and fire alarm systems, or deadbolt locks. These measures can be costly and may not produce a discount for every policy, so talk to your insurance professional for recommendations before spending money. Many insurers that sell homeowners' policies also sell auto and umbrella liability policies and may offer premium discounts for bundling (purchasing multiple insurance products). Check whether any combined price from one insurer is lower than buying the coverages separately from different companies.

Make your home more disaster-resilient. Is your home in a disaster-prone area? In that case, you may still be able to widen your insurance options by taking preparedness steps, Use fire-resistant building materials and defensible space (a buffer between your home and the surrounding area) if you live in areas prone to wildfire risk. Consider modernizing heating, plumbing, and electrical systems to reduce the risk of fire and water damage. Discuss with your insurance professional how these precautions may lower premiums and help to prevent excessive damage and rebuilding costs.

Don’t confuse the total amount you paid for your house with the rebuilding costs. A house–but not the land underneath it–can be at risk from windstorms, fire, theft, and other perils and need repairs. To avoid paying a higher than necessary premium, focus on potential rebuilding costs for the structure of your home instead of the total real estate value, which includes the price of the land.

Review your insurance coverage annually. Track the updates and changes made to your home and maintain an inventory of your belongings. Discuss this information with your insurance professional to ensure your coverage is adequate and you are not paying for coverage you no longer need. Be aware that homeowners policy prices can vary by hundreds of dollars from company to company. Getting at least three insurance estimates when shopping around is a good idea.

Keep in mind value includes service, so do your research. Don’t shop by price alone. If you need to file a claim, the last thing you’ll want is a company that cuts corners on service. Instead, you’ll want a company that provides a high-quality customer experience. Talk to your relatives, friends, and trusted colleagues about their policies. Look at the information on consumer complaint ratios maintained by your state insurance department or the National Association of Insurance Commissioners. Remember that the attention you receive during the shopping phase can indicate how a company will respond when you need to file a claim.

Marty Walker is a realtor and paid real estate consultant. Email Marty@21goldchoice.com if you have a question for Max or to receive your free market report, home valuation or Homebuyers Insurance Handbook.