Marty and Max: Market Segments

In today’s column, we are NOT going to discuss the market. Rather, we ARE discussing how to read and interpret the data when you do choose to look at the market. People often ask, “How is the market? Where is it going? How has it been?” Mark Twain said it best, “There are three types of lies: lies, damned lies, and statistics."

Statistically speaking, one may conclude that the market is up, the market is down, and the market is wherever they want it to be based on the conclusion they want to draw. What most people fail to consider when posing said question, is what is the market doing compared to WHEN? Is it up or down year-to-date? Versus this time last year? Versus the pandemic? Versus pre-pandemic norms? This is a crucial thing to consider when looking back at data.

Looking forward, everyone wants to know where the market is going. Most people can provide a very, very good suggestion of where it should or might go based on evaluating previous leading indicator trends. These trends include, but are not limited to, price reductions, days on market, inventory, median home price, etc. With all of that said, most realtors are not economists. If we laid out our best forecast there is no way any realtor can predict interest rates, pandemics, wars, acts of God, or the economy, which all factor into the market and where it is heading.

Today the greatest myth we would like to dispel is the reliance on the median price of homes in a vacuum or silo. Northern Idaho is perhaps one of the most challenging locations to achieve accurate comps. We don’t have thousands and thousands of cookie-cutter homes that are identical to compare. Unlike much of the rural United States, we have multi-million dollar homes sprinkled into our rural areas. Each zip code is unique and each segment within those zip codes even more so.

In grade school, we learned how to calculate the mean, median, and mode of any range of numbers. To find the median, you line up all of your numbers in the range and find the number that is in the middle of said range. Simple math is done on paper, but this can get tricky when applied in real estate. The median home price will give you the midrange of ALL homes on the market in a given area; golf course homes, mobile homes, homes in a development, homes on acreage, etc. We know that the top end of the market will behave differently than the bottom of the market, so we need to look further than the average across all of these homes to draw more accurate conclusions for your specific home.

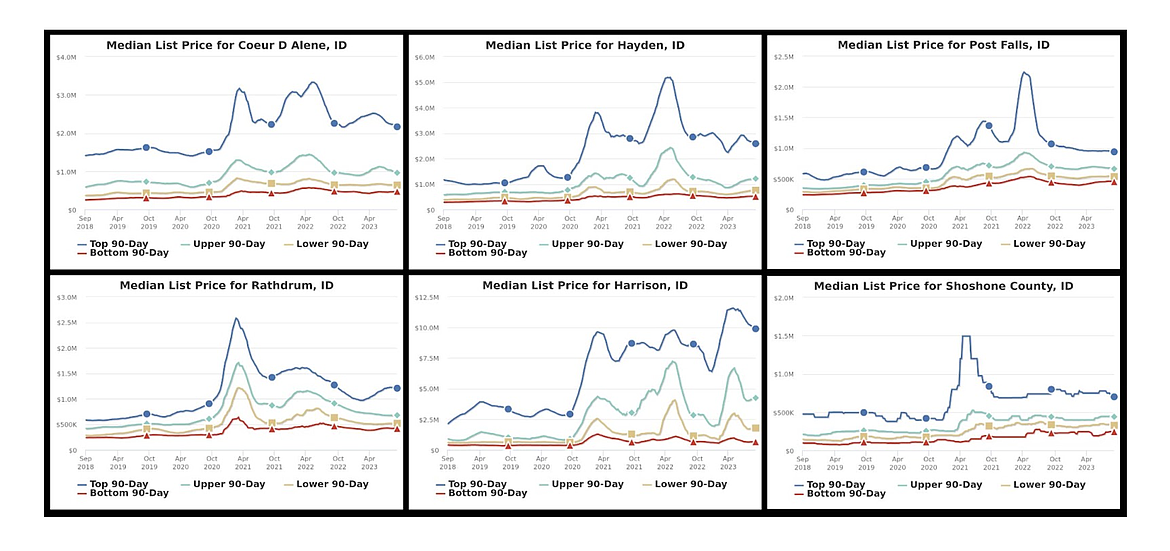

This is why we must review data, at a minimum, in quartiles. Quartiles break the market into segments: bottom 25%, lower middle 25%, upper middle 25%, and upper 25%. Once we have broken the data into these segments, we can get more useful information for our specific situations.

Let’s dig in and look at data for Coeur d’Alene, Hayden, Post Falls, Rathdrum, Harrison, and Shoshone County.

When looking at the quartiles side by side, you will notice they follow trends together, which can be due to a number of reasons (seasonal market, pandemic, interest rates, etc.). The key takeaway is to not merely look at the median price of homes for the entire market. Look at your median price based on market segments and where you fall in those segments. This will help you to make the most of the statistics provided to you and ultimately help you make a decision that is best for you.

In the movie JFK, Jim Garrison (played by Kevin Costner) said, “The FBI says they can prove it through physics in a nuclear laboratory. Of course they can prove it. Theoretical physics can also prove that an elephant can hang off a cliff with its tail tied to a daisy!” There is enough emotion and other factors when determining the price and selling your home. You must ensure you have the most up-to-date data. We track market segments by zip code.

For more information, contact Marty Walker at marty@21goldchoice.com or call (208) 518-6636. This article was not written by and does not necessarily reflect the opinions of Coeur d'Alene Regional REALTORS®